Commercial electricity rates are made up of several parts. These include the cost to generate electricity, limits on the transmission system, capacity prices, and local market conditions. In deregulated energy states, rates can differ a lot between regions or even between buildings. This article explains the main parts of a commercial electricity rate, how each part is calculated, and ways to lower or manage your business electricity costs.

What Is Commercial Electricity?

Commercial electricity is the electric power supplied specifically to businesses, offices, and commercial buildings, rather than homes or residential properties. It is designed to handle larger spaces, higher energy loads, and a greater number of devices, equipment, or appliances compared to residential electricity. As a result, commercial electricity rates are generally higher than residential rates. These rates are also determined and sold through a separate commercial energy market, which is influenced by factors such as peak demand, usage patterns, and local utility regulations.

Related Blog:

A Beginner’s Guide to Understanding Electricity Contracts and Tariffs

Factors Contributing to Commercial Electricity Rates

To understand commercial electricity rates, it’s important to know the factors that affect them. Some are similar to those for residential energy, while others are specific to commercial electricity. These factors combine to determine the total rate a business pays for electric power.

1. Government Regulations & Taxes

Government rules and taxes also play a big part in determining commercial electricity rates for your business. Local governments can create laws or impose taxes that affect how businesses buy electricity and how much they pay. These can include things like renewable energy mandates, which require utilities to produce a certain portion of electricity from renewable sources, and taxes on electricity generation or consumption. These regulations and taxes directly influence the overall cost of electricity for commercial customers.

2. Cost of Upkeep

Another factor affecting commercial electricity rates is the cost of maintaining and upgrading the energy infrastructure. As energy systems become more complex and interconnected, utility companies invest in new technologies like smart grids and energy storage to improve reliability and efficiency. These investments increase operational costs, which are reflected in business electricity rates to help cover the expenses of maintaining a modern, efficient electricity system.

3. Generation

The physical generation of electricity directly impacts the base cost of the electric commodity. This component accounts for roughly 50% of the total retail electricity price and is heavily influenced by market conditions. Fuel costs, such as the price of natural gas, affect the cost of producing electricity at natural gas peaker plants. Other factors, including weather, economic growth, and geopolitical events, also influence supply and demand, which can cause electricity prices to rise or fall.

4. Transmission

Transmission costs are the expenses of moving electricity across high-voltage power lines from one location to another. These rates are regulated and usually set in dollars per megawatt per year ($/MW/year). However, congestion on regional transmission lines can increase local electricity prices in certain areas. For example, in the PPL region of Pennsylvania, the annual cost to transmit one megawatt (MW) of electricity is about $104,055, with additional costs in specific zones due to congestion. To manage this risk, retail energy suppliers often use financial transmission rights (FTRs) contracts.

5. Capacity

Capacity costs are set annually in most markets through a base residual auction, where generators bid to meet expected future demand. These fees pay generators to remain on “standby” at all times, whether or not they are actively producing electricity. Capacity acts as an insurance policy, ensuring the grid can meet demand at all times. In most ISO/RTO markets, a business’s capacity cost is calculated based on its peak summer demand. The total price is the local capacity rate multiplied by the business’s peak demand. Because capacity fees are often included in fixed rates, a facility’s load factor (peak demand compared to annual usage) significantly affects the overall electricity price.

For example, in the PJM region, capacity rates recently surged due to rising demand and reduced available generation. To control costs, FERC set a capacity price cap in 2025. The PJM capacity price cap was reached for the 2026/27 base residual auction, meaning high capacity costs are expected to continue for several years.

6. Ancillary Services

Ancillary services are extra costs added to electricity rates in most RTO/ISO markets. These services help maintain grid stability. Generators can earn payments for supporting the grid during urgent power needs, such as providing voltage support or maintaining generating reserves. The cost of these services is passed on to the end user and usually makes up a small portion of the total electricity price.

7. Provider Profit Margin

Electricity providers also factor in their profit margin when setting commercial rates. Providers invest in new technologies and processes to meet demand, which increases their costs. They need enough revenue to cover expenses while continuing to invest in infrastructure. Raising electricity rates is one way to achieve this, but providers must also stay competitive to attract and retain customers. Balancing profit with affordability is key to maintaining a sustainable business.

How Time-Of-Use Impacts Commercial Electricity Costs

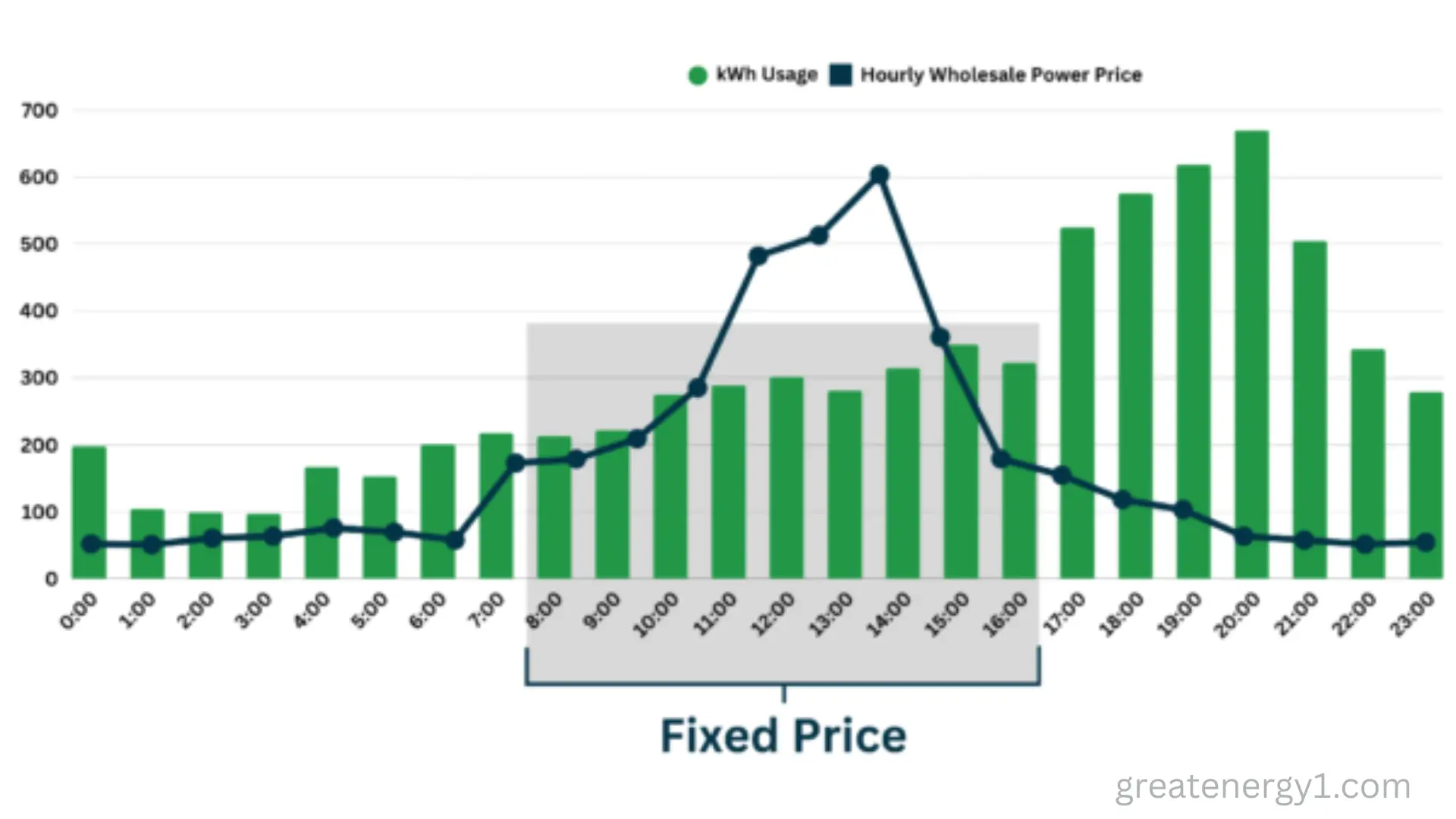

In most wholesale electricity markets, prices vary between on-peak and off-peak periods. For example, in the PJM market, on-peak hours run from 7:00 AM to 11:00 PM (Monday-Friday), while off-peak hours are 11:00 PM to 7:00 AM (Monday-Friday) and all day Saturday and Sunday. Off-peak electricity usually costs less because demand is lower during these times.

Businesses that use a lot of electricity during off-peak hours can benefit from a time-of-use utility tariff or a time-of-use retail electricity supply contract. Large energy consumers often choose hybrid energy products, like block + index plans. These allow them to pay a fixed price for on-peak hours while taking advantage of lower off-peak rates on the index market.

Related Blog:

Lessons Learned from Failed Electricity Contracts: What Not to Do

For example, a business that consumes most of its electricity at night when wholesale prices are low can save money with a block + index contract. This type of contract fixes costs during volatile on-peak hours and floats off-peak usage on the index market. Compared to a standard fixed-price plan, this approach can significantly reduce annual energy costs.

How Great Energy 1 Helps Businesses Optimize Their Power Rates

Commercial electricity rates can be complex, making it hard for businesses to manage costs. Great Energy 1 simplifies this by providing detailed bill analysis and clear cost breakdowns. We show companies exactly what drives their electricity rates.

Our best suppliers negotiate contracts that balance savings with long-term stability. We also include risk analysis in procurement strategies, helping businesses meet financial goals without taking on too much risk.

By using a proactive approach to electricity rate optimization, companies can avoid unnecessary costs and gain control over their energy strategy. For expert guidance tailored to your business, contact Great Energy 1 today to explore smarter procurement solutions.