Wholesale Electricity Market Explained

Home » Energy Brokers » Wholesale Electricity Market Explained

What You Need to Know

Exploring the Wholesale Electricity Market

The wholesale electricity market is a critical component of the energy sector, where electricity is bought and sold in bulk between generators and utility companies. These markets serve as a foundation for the retail electricity system, where consumers eventually purchase their electricity—understanding how these markets function is vital for businesses, utilities, and policymakers alike.

Get Quote

1. What Is The Wholesale Electricity Market?

The wholesale electricity market is a vital part of the energy sector, where large quantities of electricity are bought and sold between generators, utility companies, and resellers. It also includes smaller independent renewable energy producers entering the market.

2. Retail vs. Wholesale Electricity

In the U.S, electricity markets are divided into retail and wholesale markets. Although they are separate, both markets are closely connected. Retail electricity markets sell electricity directly to consumers. They focus on small transactions and customer service. Wholesale electricity markets handle large transactions between generators, suppliers, and transmission operators. Wholesale prices help set the rates for retail electricity.

| Feature | Retail Electricity Market | Wholesale Electricity Market |

|---|---|---|

| Transaction Size | Small (individual consumers) | Large (generators, suppliers, utilities) |

| Focus | Customer service, billing | Bulk electricity trading, pricing |

| Regulation | Local state regulations | Federal regulations (FERC) |

| Customer Choice | Available in deregulated markets | Not applicable |

| Pricing Influence | Affected by wholesale prices | Sets the base price for retail markets |

2.1 Retail Deregulation: Customer Choice

In deregulated areas, customers can choose their electric supplier. This is called customer choice. Customers can pick from different suppliers instead of buying electricity from the local utility. This creates competition in electricity prices.

Many electric suppliers can operate in a deregulated area. To attract customers, they offer competitive prices. If customers do not choose an independent supplier, their local utility will still supply electricity. The utility will buy electricity from generators to provide for them.

There are pros and cons to choosing a supplier other than the local utility. Retail competition can lower electricity bills and allow customers to choose clean energy. However, some independent suppliers require contracts. These contracts lock customers into a fixed electricity price for a certain time. This can be good for some but bad for others if the fixed cost exceeds the utility’s price.

Customer choice only applies to the generation part of the electricity bill. The local utility still provides transmission and distribution services. These services are a natural monopoly, so they do not have competition. Only part of the electricity bill is affected by customer choice.

| Pros of Choosing an Independent Supplier | Cons of Choosing an Independent Supplier |

|---|---|

| Potentially lower electricity rates | Contract commitments with fixed prices |

| Option to choose clean energy sources | May exceed local utility prices if market rates fall |

| Competitive Pricing | Possible cancellation fees |

2.2 Wholesale Deregulation: Creation of Competitive Wholesale Markets

In deregulated states, markets decide which power plants are needed for electricity. Unlike regulated states, where the government plans for investment, deregulated states let the market decide. Utilities and competitive retailers in deregulated areas don’t generate their electricity. They buy electricity from other sources for their customers.

Wholesale markets are used to buy and sell electricity. In these markets, electricity generators sell electricity, and companies that serve consumers buy it to sell to their customers. This system is more efficient and saves money. In deregulated markets, the risk of investing in power plants falls on the electric suppliers, not the customers. This is different from regulated markets.

After deregulation, regional transmission organizations (RTOs) took over the role of grid operators. They also manage wholesale electricity markets. RTOs have changed over time.

Learn More About Competitive Wholesale Markets!

2.3 Regional Transmission Organization Map

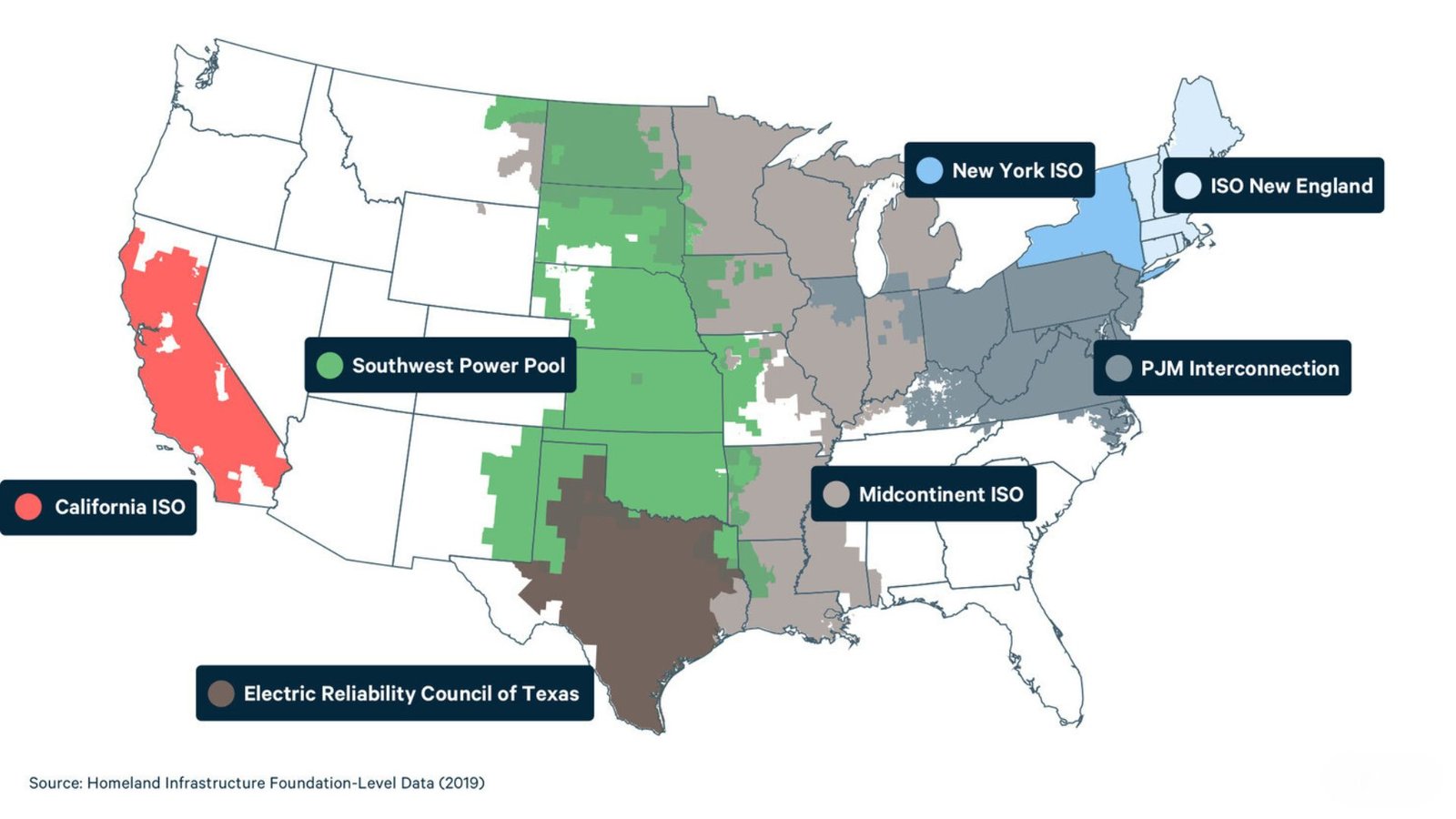

RTO Map Many RTOs manage wholesale markets in several states. They are regulated by FERC, except for the Texas RTO (ERCOT). FERC oversees all power transactions in the two large interconnected grids: the eastern and western grids.

In regulated markets, utilities set retail prices based on a fixed rate of return. However, in deregulated markets, retail utilities buy electricity at market prices and sell it to customers at competitive prices. RTOs typically run three types of markets that set wholesale prices: energy markets, capacity markets, and ancillary services markets.

3. Wholesale Electricity & Energy Deregulation

As deregulation spreads nationwide, wholesale electric markets have become more important. These markets help retailers buy electricity. This is especially true in states where energy markets are open to competition. Retailers can now buy wholesale electricity and offer consumers lower prices.

The wholesale electricity market is always changing. New players and energy products are entering the market. Consumers need to understand how this market works and how it affects their energy choices.

4. Types of Wholesale Electricity Markets

There are two main types of wholesale electric markets:

1. Physical Markets

2. Financial Markets

| Type of Market | Description |

|---|---|

| Physical Electricity Market | Deals with the actual generation and transmission of electricity, influenced by supply and demand. |

| Financial Electricity Market | Involves trading futures contracts to stabilize prices, mainly for budgeting and risk management. |

4.1 Physical Electricity Markets

Physical electricity markets deal with the real generation and transmission of electricity. Since electricity is a product people use, its price depends on supply and demand.

4.2 Financial Electricity Markets

Financial electricity markets involve banks, brokers, and traders. They set the future price of electricity. These markets help utilities and customers buy electricity in advance at fixed prices. This is known as a futures contract. It helps keep prices stable and makes it easier for customers to manage their budgets.

5. Exploring How the Wholesale Energy Market Work

There are different types of participants in wholesale energy markets. To understand how these markets work, we need to know the role of each participant.

| Participant | Role in the Market |

|---|---|

| Electricity Generators | Produce electricity using various fuel sources |

| Transmission Owners | Carry high-voltage electricity from power plants to utilities |

| Electric Grid Operators | Balance supply and demand on the grid |

| Utilities | Deliver power to end consumers; manage billing |

| Retail Energy Suppliers | Buy wholesale electricity and sell to end-users in deregulated states |

| Energy Brokers | Help customers negotiate electricity contracts |

5.1 Electricity Generation

Electricity generation is the process of making electricity. It is usually measured in kilowatt-hours (kWh) or megawatt-hours (MWh). This is the first step in the electricity supply chain. The main ways to generate electricity are natural gas, coal, nuclear energy, hydro, wind, solar, or biomass. Electricity generators are companies that produce electricity. Others then use this electricity in the supply chain.

5.2 Electricity Transmission

Electricity transmission owners carry electricity from power plants to electric utility companies at high voltage. In some states, transmission lines are privately owned. In other states, they are owned by public utility companies. Transmission is the second step in the power supply chain. These companies make sure electricity is safely and reliably supplied across the country.

5.3 Electricity Grid Operators

Electric grid operators control the flow of electricity across the transmission network. They constantly watch the supply and demand of electricity to keep them balanced. They send electricity from power plants to different grid parts when needed to meet demand. Later, we will learn how they decide the wholesale price of electricity.

5.4 Utilities

Electric utilities are public companies. They deliver power through local utility lines to homes and businesses. In regulated states, these companies often own power plants and transmission lines. In deregulated states, electric utilities only deliver electricity and handle billing. They are important in the electricity market because they ensure electricity is safely delivered to local areas.

5.5 Retail Energy Suppliers

Retail energy suppliers sell electricity to consumers in deregulated energy states. They buy electricity from the wholesale market and sell it to homes and businesses. These suppliers do not own transmission lines or local delivery lines. They are only involved in the financial side of the energy scale. In some cases, they may also own power plants where electricity is generated.

Have Questions About the Wholesale Energy Market?

5.6 Customers

Customers receive the electricity, which is then used in factories, restaurants, gyms, and homes. Energy brokers also work in retail markets. They help customers negotiate buying electricity or natural gas from retail suppliers.

6. Overview of the U.S. Wholesale Electricity Markets and Regional Grid Operators

Wholesale electricity markets in the U.S. are managed by various regional grid operators, each serving specific geographic areas and governed by unique regulatory requirements. Here’s an in-depth look at each major market and operator across the country:

| Region | Electricity Hub Name | ICE Electricity Product Name |

|---|---|---|

| New England | Mass Hub | Nepool MH DA LMP Peak (from 2001) |

| PJM | PJM West | PJM WH Real-Time Peak (from 2001) |

| Midwest | Indiana Hub | Indiana Hub RT Peak (from 2006) |

| Texas | ERCOT North | ERCOT North 345KV Peak (from 2014) |

| Northwest | Mid-C | Mid C Peak (from 2001) |

| Northern California | NP-15 | NP15 EZ Gen DA LMP Peak (from 2009) |

| Southwest | Palo Verde | Palo Verde Peak (from 2001) |

| Southern California | SP-15 | SP15 Gen DA LMP Peak (from 2009) SP-15 Peak (2001 to 2009) |

6.1 California (CAISO)

The California Independent System Operator (CAISO) runs a competitive electricity market. It manages the reliability of the electricity grid. CAISO provides open access to the grid and plans for the future.

In managing the grid, CAISO controls power generation and moves wholesale electricity in California and parts of Nevada. CAISO’s markets include energy (both day-ahead and real-time), services for backup power, and congestion revenue rights.

CAISO also runs an Energy Imbalance Market (EIM). This market includes CAISO and other areas in the western United States.

CAISO was founded in 1998 and became fully operational in 2008. The EIM started in 2014, with PacifiCorp as the first member. The EIM covers parts of Arizona, Oregon, Nevada, Washington, California, Utah, Wyoming, and Idaho.

6.2 New England (ISO-NE)

ISO-NE is the Regional Transmission Organization (RTO) for New England. It manages wholesale electricity markets where electricity, capacity, transmission contracts, and other products are traded. ISO-NE also runs auctions to sell capacity. It operates New England’s high-voltage transmission network and plans for the system’s future.

ISO-NE serves six states: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont. The highest peak load in New England was 28 G.W. in the summer of 2006.

ISO-NE works with the New York Independent System Operator (NYISO), TransEnergie (Québec), and the New Brunswick System Operator. It imports about 17% of its annual energy needs from these regions.

In ISO-NE’s Forward Capacity Auction (FCA), generators and demand resources offer capacity three years before it is needed. This three-year lead time helps encourage new resources and allows the market to adjust when resources leave.

In 2016, ISO-NE mostly relied on natural gas (49%) and nuclear (31%) for its energy supply.

| Energy Source | Percentage (ISO-NE) |

|---|---|

| Natural Gas | 49% |

| Nuclear | 31% |

| Other | 20% |

6.3 New York (NYISO)

The Federal Energy Regulatory Commission (FERC) authorized the creation of the New York Independent System Operator (NYISO) in 1998. It began operations on December 1, 1999. The NYISO covers all of New York state. It manages wholesale electricity markets where electricity, capacity, transmission contracts, and related products are traded. It also runs auctions for capacity sales. NYISO operates New York’s high-voltage transmission network and long-term planning.

There are ongoing transmission problems in the southeastern part of New York, especially leading into New York City and Long Island. These areas have large populations and are the biggest electricity users. Energy flows from the West and north toward these areas, pushing the transmission system to its limits. This causes transmission problems and increases electricity prices in New York City and Long Island.

6.4 PJM

PJM Interconnection runs a competitive electricity market and ensures grid reliability. It provides open access to transmission and handles long-term planning. PJM manages power generation and electricity movement in 13 states and Washington, D.C. Its markets include energy, capacity, and support services.

PJM started in 1927 with three utilities in Pennsylvania and New Jersey. One thousand nine hundred fifty-six, two Maryland utilities joined, becoming the Pennsylvania-New Jersey-Maryland Interconnection (PJM). It became an independent system operator (ISO) 1996 and launched markets with bid-based pricing in 1997. PJM was named a regional transmission organization (RTO) in 2001.

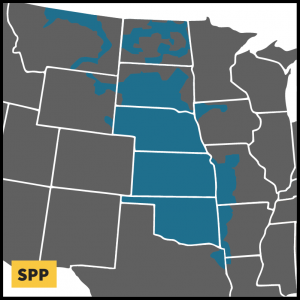

6.5 Southwest Power Pool (SPP)

Southwest Power Pool (SPP) started in 1941 with 11 members. It became an RTO in 2004. SPP ensures its members get reliable power, good transmission, and fair electricity prices. SPP is based in Little Rock, Arkansas. It manages power in 14 states: Arkansas, Iowa, Kansas, Louisiana, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Oklahoma, South Dakota, Texas, and Wyoming. Its members include utility companies, cooperatives, and others.

In 2007, SPP began its real-time Energy Imbalance Service (EIS) market. It also became a FERC-approved Regional Entity. This means SPP helps make sure the region follows reliability rules.

In March 2014, SPP started its Integrated Marketplace. It has a day-ahead energy market, a real-time energy market, and an operating reserve market. It also has a market for Transmission Congestion Rights. The marketplace helps use energy least expensively.

In 2015, SPP grew larger. It added the WAPA-UGP region, Basin Electric Power Cooperative, and Heartlands Consumer Power District. This nearly doubled the service area. It said more than 5,000 MW of peak demand and 7,000 MW of power. WAPA-UGP was the first federal agency to join an RTO.

6.6 Texas (ERCOT)

The Electric Reliability Council of Texas (ERCOT) is an independent system operator. It manages the flow of electricity to 24 million customers in Texas, covering about 90% of the state’s electrical needs. ERCOT runs a competitive electricity market. It ensures reliability across 46,000 miles of power lines and around 550 power plants.

ERCOT operates an energy-only market. It has real-time, day-ahead, and ancillary service markets. It also handles financial settlements for the wholesale electricity market. ERCOT manages retail switching for 7 million homes in areas with competitive electricity choices.

A 16-member board governs ERCOT. The board comprises consumers, cooperatives, power generators, electricity marketers, retail providers, and utilities. ERCOT is overseen by the Public Utility Commission of Texas and the Texas legislature.

6.7 Midcontinent (MISO)

MISO manages the transmission system and a central market in 15 states. These states are from Michigan and Indiana to Montana and from the Canadian border to Louisiana and Mississippi. MISO operates from three control centers: Carmel, Indiana; Eagan, Minnesota; and Little Rock, Arkansas. It also helps manage systems outside its area, mostly to the north and northwest.

MISO was not a power pool before December 2001. It started market operations in April 2005. In January 2009, MISO began running an ancillary services market and combined 24 balancing areas into one. In 2013, MISO started operations in the South region, which includes parts of Arkansas, Mississippi, Louisiana, and Texas.

6.8 Northwest

The West includes the Northwest Power Pool (NWPP), Rocky Mountain Power Area (RMPA), and Arizona, New Mexico, and Southern Nevada Power Area (AZ/NM/SNV), all part of the WECC. These areas have balancing authorities (B.A.s) that manage power, the grid, and reserves. Some B.A.s share transmission planning and reserves.

The NWPP covers parts of seven states and two Canadian provinces, spanning 1.2 million square miles. It has 20 B.A.s. Peak demand is 54.5 GW in summer and 63 GW in winter, with 80 GW of generation capacity, including 43 GW from hydroelectric power.

6.9 Southwest

The Southwest electric market includes Arizona, New Mexico, southern Nevada, and the Rocky Mountain Power Area. Summer peak demand is about 42 G.W. The area has 50 G.W. of generation capacity, mainly from gas and coal plants.

Nuclear and coal plants provide steady power. Gas plants are used during peak demand. Coal plants are close to mines, which lowers fuel costs. The Palo Verde nuclear plant, with 4,000 MW, is owned by utilities in California and the Southwest.

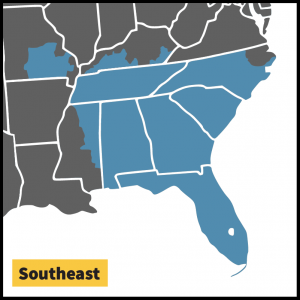

6.10 Southeast

The Southeast electricity market is a bilateral market. It covers parts of Florida, Georgia, Alabama, Mississippi, North Carolina, South Carolina, Missouri, and Tennessee. This market includes parts of two NERC regions: the Florida Reliability Coordinating Council (FRCC) and the Southeastern Electric Reliability Council (SERC).

Utilities in the Southeast are vertically integrated. Most electricity sales are done bilaterally. The resource mix in the Southeast varies by region. The FRCC mainly uses natural gas. Other parts of the Southeast mostly use coal and nuclear plants. But in recent years, natural gas has become cheaper and is used more for electricity generation.

The Florida Public Service Commission (PSC) has rules for competitive bidding. Investor-owned utilities (IOUs) must request proposals for new projects of 75 M.W. or more, except for single-cycle combustion turbines. The PSC can waive the bidding rule if the IOU shows it is not in the best interest of its ratepayers.

7. Historical Wholesale Market Data

8. How is the Wholesale Price of Electricity Set?

Electricity grid operators are in charge of maintaining the electrical transmission network. They ensure that the electricity supply and consumer demand always stay balanced.

These operators also help decide the wholesale cost of electricity. However, they are not focused on the price. Their main job is to make sure there is enough power to meet the demand.

Grid operators dispatch electricity from generators to meet this demand. Sometimes, they can use power from low-cost plants. Other times, they must turn on high-cost plants to quickly meet demand.

The difference in the cost of power from different plants affects the hourly price of electricity in wholesale markets. The price of the last generator used to meet demand for that hour sets the price for the entire hour. In wholesale markets, all generators are paid the same price per kilowatt of power they produce each hour.

9. Key Components of Wholesale Energy Price

Let’s examine how wholesale electricity costs are calculated, focusing on generation, transmission, and distribution. This explanation is based on traditional electric grids. Some rules may not apply to distributed energy or community solar projects as the world moves towards renewable energy.

| Component | Description |

|---|---|

| Electric Generation | Costs associated with producing electricity (set by market bidding) |

| Transmission | Fees for using transmission lines, regulated by FERC |

| Distribution | Local delivery charges set by utility companies |

9.1 Electric Generation Costs

In most wholesale electricity markets, electric generation companies get paid the same rate for each unit of energy they produce. This may sound unusual, but the free market sets the price. Generators bid to supply electricity to grid operators for each hour of the day. The bids are listed from lowest to highest. The highest bid needed to meet demand sets the generators’ price.

Retail customers must see how this works, as it happens behind the scenes. Retail electricity suppliers must pay the hourly price to generation companies. To make it easier for customers, suppliers use other financial tools to show a simple cost per kilowatt-hour (kWh) on their bills.

In the energy industry, generation costs refer to producing electricity. This is sometimes called the “energy cost.”

9.2 Electric Transmission Costs

Transmission costs are different from generation costs. These costs are paid to the companies that own the transmission lines, which carry electricity from power plants to local utilities. Transmission companies invest heavily in building new lines, so the Federal Energy Regulatory Commission (FERC) allows them to earn a fixed return on their investment. The price for electricity transmission is set at the utility level since transmission lines across many regions.

Another important transmission cost is the financial transmission rights (FTR). Energy traders and retail suppliers buy These contracts in the wholesale market to hedge against future energy congestion costs. These FTR costs are usually included when consumers pay a fixed energy rate.

9.3 Electric Distribution Costs

Distribution costs are not part of the wholesale market but are still important for consumer costs. These fees are calculated based on energy demand and are usually billed in dollars per kilowatt (kW). Each utility company in the U.S. sets rates for different customer types (residential, commercial, industrial, etc.). These rates determine the cost of electrical distribution.

Commercial customers can choose different rate plans if their energy use meets certain conditions. Changing to a lower-cost plan can save money. A utility bill audit can help find the best distribution plan.

Contact Us for Expert Advice

10. The Advantage of Wholesale Electric Markets

Wholesale electric markets provide several benefits for consumers. First, they helped with the deregulation of energy in the U.S. Wholesale markets were created before states allowed consumers to choose their retail electricity suppliers.

Another benefit is the creation of financial futures markets. This allows consumers to lock in fixed electricity prices for years, avoiding the risk of fluctuating prices. This can help businesses remain stable and profitable by budgeting energy costs.

11. Who Can Buy Wholesale Electricity?

Retail suppliers, utilities, and energy traders mainly buy wholesale electricity. In deregulated states, entities must have a license and post-financial collateral or be considered a load-serving entity (LSE) to purchase wholesale electricity.

However, some large power users can register in the wholesale market to buy electricity directly from the grid. Some retail energy suppliers even offer programs for large consumers to help with this process.

12. How to Buy Wholesale Electricity

If your business is a large consumer of electricity and you want to buy wholesale electricity, you have two options:

12.1 Retail Supplier Products

While not a true wholesale product, some retail suppliers let large customers access wholesale markets using their licenses. Some suppliers also offer hybrid energy products, such as block + index power, which mimic wholesale prices.

12.2 Register as a Load-Serving Entity (LSE)

The only way for end users to buy wholesale electricity directly is to register as an LSE with the electric grid. This is the same process that retail electricity suppliers follow. Becoming an LSE requires significant financial investment and market knowledge. However, large power consumers who are LSEs can buy electricity at wholesale prices.

Schedule a Consultation with Our Energy Advisors Today

13. The Future of Wholesale Electricity Markets

Many states have rules to help use cleaner energy, like wind and solar power. As more renewable energy is used, there could be problems with the current wholesale market in states where prices are not controlled. Renewable energy sources, like wind and solar, do not need fuel to make power. They use natural resources such as the sun and wind. This lets them offer bids of $0 in energy and capacity markets.

As renewable energy becomes a bigger part of the grid, these $0 bids could lower wholesale energy prices. This may make it harder for other types of energy to get investments. Because of this, wholesale markets need to change. They will need to adjust to work better with different kinds of energy.

14. Want to Explore Wholesale Electricity for Your Business?

In conclusion, wholesale electricity is complex and involves many players. It’s important to understand how these markets work with retail energy. This will help you control your business’s energy costs. If you want to learn more about wholesale electricity options for your business, contact our team of energy market experts today!